Investors have been pushing stocks higher in recent days as pressure grows on Republicans and Democrats to resolve differences over a new U.S. virus relief package, especially with jobs data Wednesday painting a grim picture. Gains in precious metals suggest traders are nervous about the outlook for the global economy and seeking a hedge.

“Stock markets in general have been underpinned by expectations for further stimulus out of the U.S.,” said Candice Bangsund, portfolio manager of global asset allocation at Fiera Capital Corp. “The second-quarter earnings season has also lent some notable support and helped to counteract some of the fears about the latest resurgence in Covid cases.”

U.S. economic data was mixed, with payroll gains slowing sharply in July, suggesting the pickup in coronavirus cases is putting the brakes on the job market. Meanwhile, service industries expanded in July at the fastest pace since February 2019.

Here are some key events coming up:

- Reserve Bank of India and Bank of England rate decisions due Thursday.

- Dallas Fed President Robert Kaplan discusses the U.S. economy at Thursday event.

- July U.S. employment and jobs reports expected Friday.

These are some of the main moves in markets:

Stocks

- The S&P 500 Index advanced 0.7% as of 2:36 p.m. New York time.

- The Stoxx Europe 600 Index gained 0.5%.

- The MSCI Asia Pacific Index climbed 0.7%.

- The MSCI Emerging Market Index advanced 1.2%.

Currencies

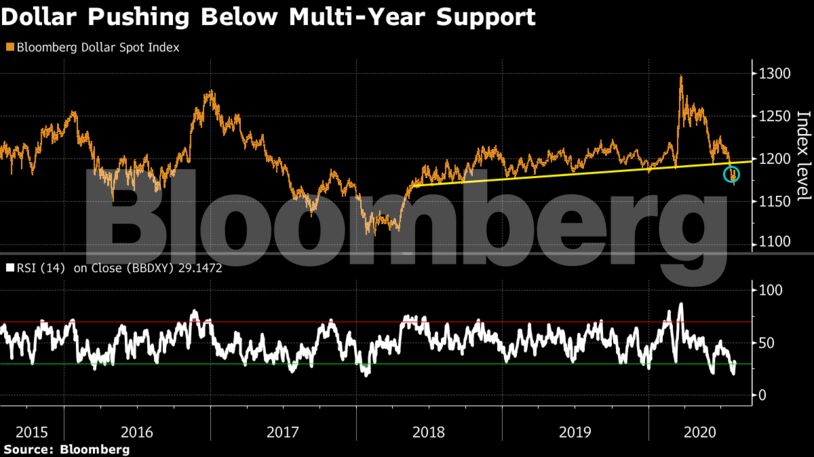

- The Bloomberg Dollar Spot Index declined 0.5%.

- The euro increased 0.5% to $1.186.

- The Japanese yen rose 0.1% to 105.63 per dollar.

Bonds

- The yield on 10-year Treasuries added three basis points to 0.54%.

- Germany’s 10-year yield increased five basis points to -0.51%.

- Britain’s 10-year yield climbed five basis points to 0.13%.

Commodities

- West Texas Intermediate crude added 1.1% to $42.17 a barrel.

- Gold strengthened 0.9% to $2,037.08 an ounce.

Become an Insider

Become an Insider