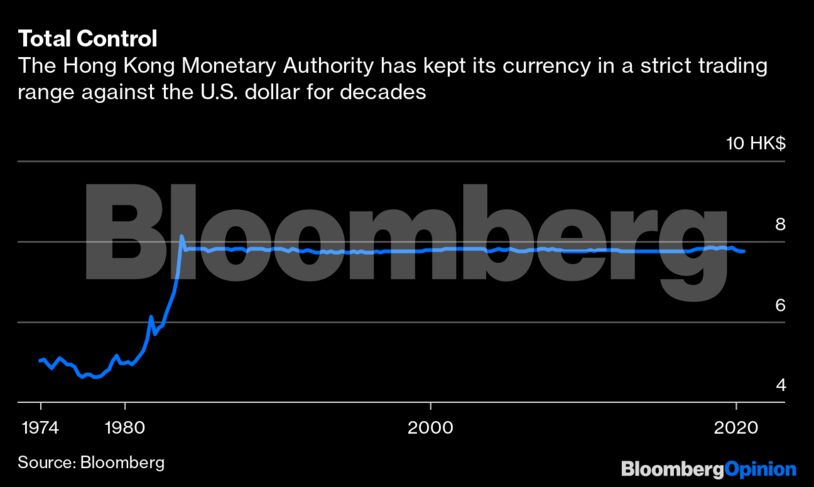

(Bloomberg Opinion) — Hong Kong has maintained a strict relationship between its currency and the U.S. dollar since 1983. The Hong Kong Monetary Authority has intervened whenever the Hong Kong dollar has threatened to breach a designated trading band, most recently set in 2005 at HK$7.75 to HK$7.85. As other fixed-currency regimes have come and gone, this one has been phenomenally successful.

Nevertheless, hedge fund manager Kyle Bass reckons its days are numbered.

A few months ago, Bass began soliciting potential investors for a new fund planned to start on June 1 that would make a winner-takes-all bet against the Hong Kong dollar. His firm, Hayman Capital Management LP, plans to leverage the wager by 200 times, using the options market. Investors stand to make 64 times their money should the Hong Kong currency decline by 40% against its U.S. counterpart. But the downside is 100%; if the peg remains intact after 18 months, they’ll lose everything.

Bass isn’t the first money manager trying to make a profit from betting against the peg. Billionaire investor George Soros made a similar bet in 1998, during the Asian financial crisis. He failed. “They actually did a very good job defending the Hong Kong dollar,” he conceded in 2009.

London-based hedge fund manager Crispin Odey spent two years running the trade before abandoning it in mid-2018. “There are lots of good bets around,” he told my Bloomberg News colleague Nishant Kumar in August. “Hong Kong dollar is not there.” And as anti-government protests engulfed Hong Kong last year, other hedge funds began to speculate that capital would flee and undermine the currency fix.

But even as a geopolitical row escalates over China’s recent imposition of laws that restrict political criticism in the former British colony, the currency is gaining rather than declining. The HKMA sold HK$13.4 billion ($1.7 billion) on Thursday, buying U.S. dollars to prevent its own currency from strengthening, my Bloomberg News colleague Sofia Horta e Costa reported. In total, the city’s de facto central bank has spent $13.5 billion this year to stop the local currency from breaching its maximum permitted value of HK$7.75.

That renewed test of its upper trading limit comes even after Bloomberg News reported Wednesday that advisers to President Donald Trump have argued in favor of undermining the peg to retaliate against China. The currency market seems to be concurring with the economists and traders who reckon market hostility won’t break out between the U.S. and China, arguing it would mostly hurt Hong Kong’s banks rather than China.

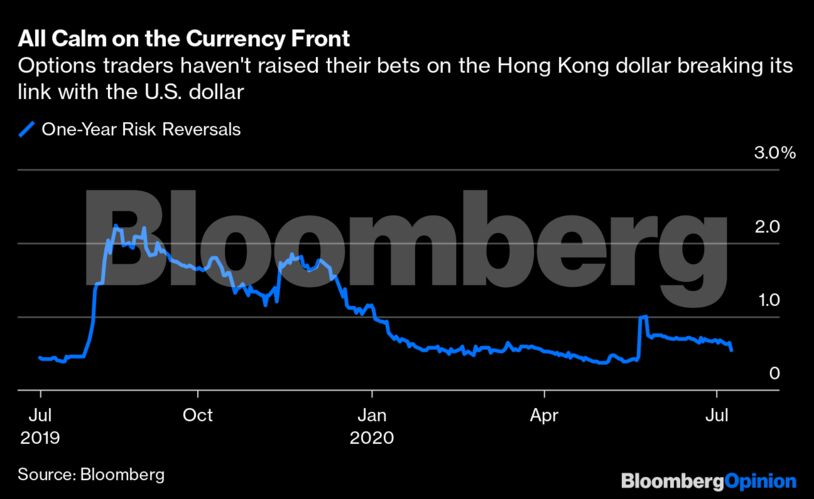

Moreover, risk reversals — the difference in volatility between calls and puts that indicates where options traders are anticipating a currency’s value will head — suggest there’s minimal speculation about the Hong Kong dollar breaking its range, and less than there was either a few months ago or last year.

Bass, who said in January that Hong Kong faces “a full-fledged banking crisis” this year, has been betting against the currency peg since at least May 2019. So far, he isn’t faring any better than his predecessors. The widowmaking trade is striking again.

Become an Insider

Become an Insider