The escalation in tensions between the U.S. and China last month had threatened to derail a recovery in global equities. While the U.S. president’s speech Friday was heated in rhetoric, it lacked specifics around measures that would directly affect Beijing.

“President Trump’s response on Friday was pretty muted and far less disruptive than markets had feared,” said Shane Oliver, head of investment strategy at AMP Capital Investors Ltd. in Sydney.

The U.S. president also promised sanctions against Chinese and Hong Kong officials “directly or indirectly involved” in eroding Hong Kong’s autonomy but didn’t identify individuals. The administration hasn’t yet decided under what authority it would implement that action, according to a person familiar with the matter.

“The impact is likely to be limited and more symbolic while the financial sector is unlikely to be affected,” Sean Darby, Jefferies’ global equity strategist in Hong Kong, wrote in a research note. “We are not too surprised by the move and don’t expect the Hong Kong financial markets to be either.”

Here are some key events coming up:

- Australia’s central bank is expected to keep its main policy programs unchanged on Tuesday. So too is the case for Canada, which has options to add stimulus but will probably stand pat on Wednesday to allow more time to evaluate the progress of policy action.

- In Europe, the ECB is expected to top up its rescue program with an additional 500 billion euros of asset purchases. Anything less than an expansion at Thursday’s meeting would be a big shock, Bloomberg Economics said.

- The U.S. labor market report on Friday will probably show American unemployment soared to 19.6% in May, the highest since the 1930s.

These are the main moves in markets:

Stocks

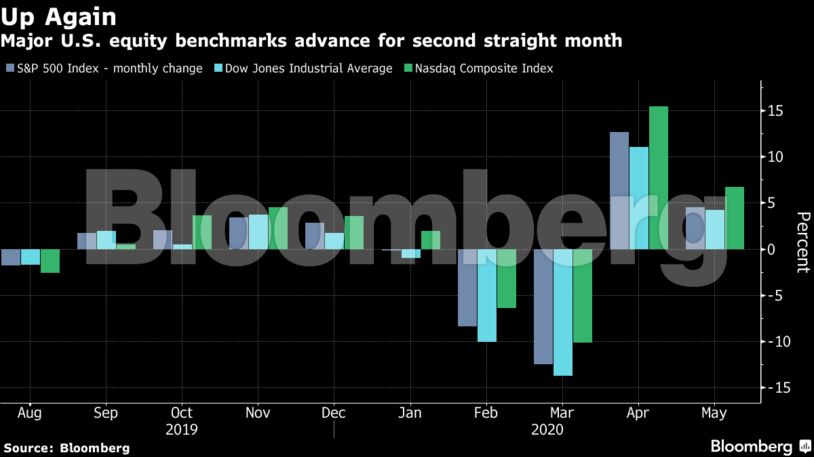

- Futures on the S&P 500 Index rose 0.1% as of 10:50 a.m. in Tokyo. The index climbed 0.5% on Friday.

- Japan’s Topix index rose 0.5%.

- Hong Kong’s Hang Seng advanced 3.4%.

- South Korea’s Kospi index rose 1.3%.

- Australia’s S&P/ASX 200 Index gained 0.7%.

- Euro Stoxx 50 futures advanced 1.3%.

Currencies

- The yen rose 0.1% to 107.68 per dollar.

- The euro bought $1.1135, up 0.3%.

- The offshore yuan rose 0.1% to 7.1263 per dollar.

- The Australian dollar climbed 0.9% to 67.27 U.S. cents.

Bonds

- The yield on 10-year Treasuries rose one basis point to 0.66%.

- Australia’s 10-year yield was at 0.90%, up about one basis point.

Commodities

- West Texas Intermediate crude fell 0.6% to $35.27 a barrel.

- Gold rose 0.4% to $1,737.21.

Become an Insider

Become an Insider