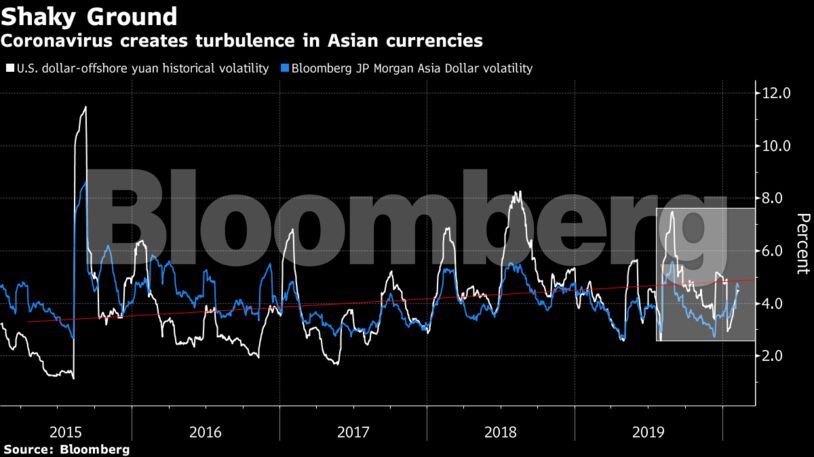

Take the yuan. After rising more than 1.5% in the month prior to the Jan. 15 signing of the U.S.-China trade agreement, the currency has relinquished those gains amid concerns that Chinese growth could stumble as the coronavirus spreads. Singapore, a key financial hub, is seeing historic price swings due to angst around the outbreak.

The uncertainty has helped lift Asian currency volatility to its highest level in six months and the greenback to a two-month high, a development that could rekindle efforts by the U.S. administration to “talk down” the dollar.

In addition to anxiety about growth, the yuan may also sway more freely due to a clause in the phase-one trade deal that reaffirms commitments to refrain from competitive devaluation, said Alan Ruskin, Deutsche Bank’s chief international strategist.

China “will have a harder time in general containing volatility if the U.S. is on the lookout for intervention, or surrogate intervention,” Ruskin said by phone.

Both the Australian dollar-yen and New Zealand dollar-yen are “risk blow-up pairs” and can be used as proxies for capturing potential volatility in Asia, Ruskin said. One-year volatility in both pairs is relatively cheap compared to most other Group-of-10 peers, he said.

Record low implied volatility in Europe’s common currency against the U.S. dollar may have an outsized impact on depressing broader gauges of price swings. But it doesn’t mean the euro isn’t subject to choppiness elsewhere. Implied volatility in euro-Swiss franc, a barometer of global risk appetite, has climbed to a premium to euro-dollar volatility. At the lowest in more than two years in the spot market, euro-franc is teetering near a key technical level, a breach of which could spark a sharp move lower by the common currency.

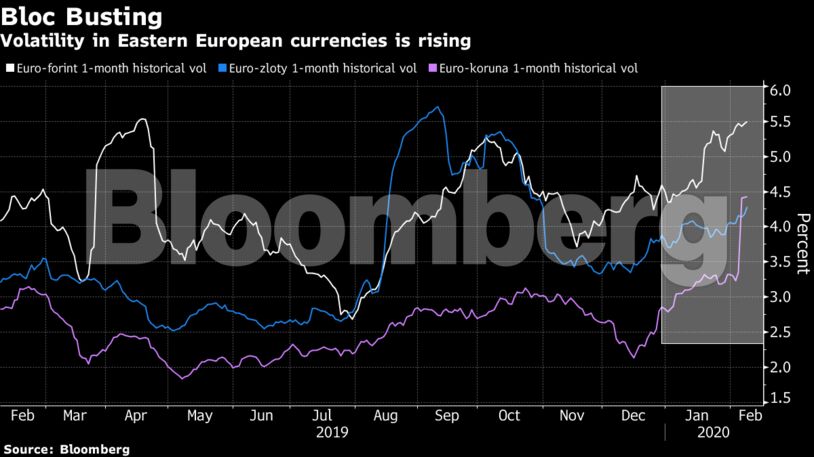

Meanwhile, Eastern European currencies have also seen price swings as central bank policy rates diverge. On Thursday, the Czech central bank unexpectedly raised rates 25 basis points to 2.25% to tame inflation pressures.

Whether these pockets of turbulence spread to the broader market could depend on several factors. To be sure, volatility may not return to levels seen a decade ago should central banks continue to actively use their balance sheets to manage liquidity issues or regulatory barriers to capital movement arise.

Still, the efficacy of persistent central bank accommodation is already being questioned by policy makers including European Central Bank President Christine Lagarde. It may be a more contentious topic should inflation rise and business activity pick up.

Meanwhile, American targeting of currency devaluations may prompt global officials to slow the pace of intervention. Geopolitical events such as the U.S. presidential elections add an element of uncertainty.

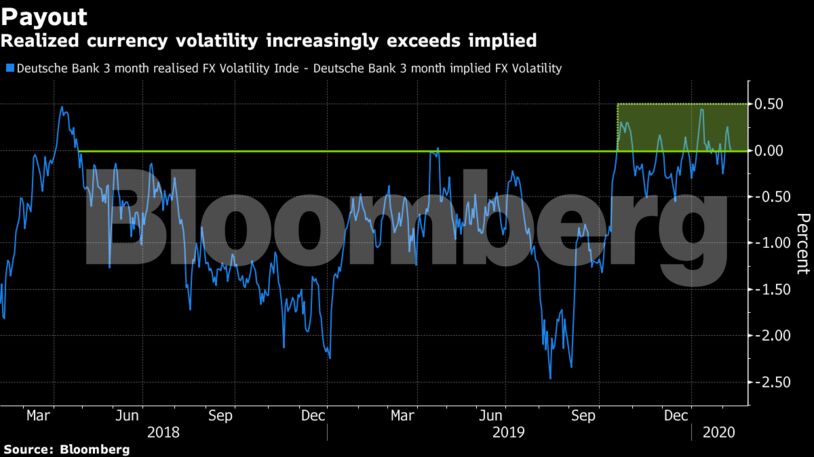

Falling euro volatility has not prevented realized volatility, as measured by the Deutsche Bank CVIX index, from climbing above its implied counterpart, making conditions more appealing for option-buyers. For funding currencies like the euro and yen to move out of a low-volatility regime, short-term realized volatility needs to demonstrate that it has staying power, a condition that would likely require a rise in long-term implied volatility and a weeding out of mean-reverting trading strategies.

Markets may have to strap in as early as this week, when Federal Reserve Chairman Jerome Powell gives his semi-annual congressional testimony.

Become an Insider

Become an Insider