Read: Hope Fading Fast for Fourth-Quarter Earnings Rebound in S&P 500

The American manufacturing miss countered signs of recovery in China and Europe. It also revived concern about the U.S. economy and could reignite bets on further Federal Reserve easing, according to Eimear Daly, a currency strategist at Macquarie Bank. Earlier Monday, Trump again called on the Fed to loosen monetary policy.

Traders also monitored the latest on retail after Black Friday hit a record $7.4 billion in U.S. online sales. American shoppers are on track to spend an estimated $9.4 billion on Cyber Monday — a record — boosting an already robust holiday shopping season. Yet a gauge of retailers in the S&P 500 dropped on Monday, joining broader market losses.

More on corporate news:

- Roku Inc. sank after Morgan Stanley cut its rating and warned that revenue and gross profit growth may “slow meaningfully” next year.

- Apache Corp. tumbled after the company’s update on an exploratory oil well off the coast of Suriname offered little indication as to whether it will be commercially viable.

- Biogen Inc. slumped after being downgraded at Robert W. Baird, which warned investors ahead of a company presentation at a medical meeting later this week.

Elsewhere, oil rebounded from the biggest weekly loss since October on speculation OPEC+ could defy expectations by deepening production cuts.

Here are some key events coming up this week:

- Saudi Aramco’s initial public offering is scheduled to be priced on Thursday.

- Friday brings the U.S. jobs report, where estimates are for non-farm payrolls to rise by 190,000 in November.

These are the main moves in markets:

Stocks

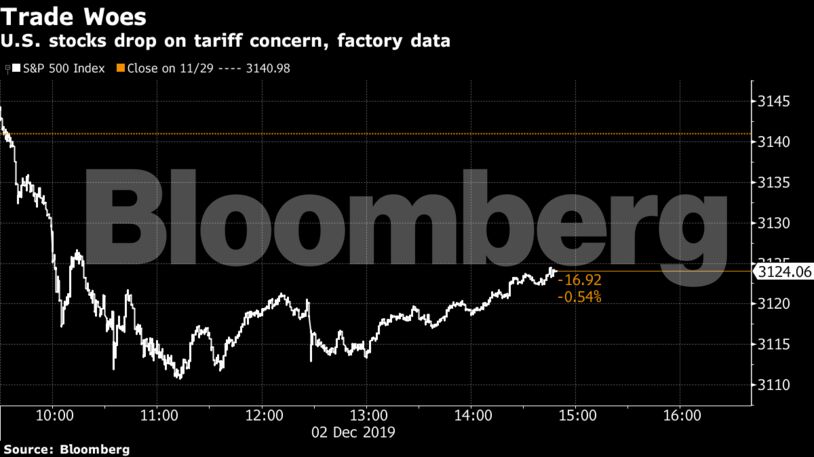

- The S&P 500 slid 0.5% to 3,124.03 as of 2:56 p.m. New York time.

- The Stoxx Europe 600 Index sank 1.6%.

- The MSCI Asia Pacific Index rose 0.7%.

Currencies

- The Bloomberg Dollar Spot Index fell 0.3%.

- The euro climbed 0.5% to $1.1073.

- The Japanese yen appreciated 0.5% to 108.99 per dollar.

Bonds

- The yield on 10-year Treasuries climbed five basis points to 1.83%.

- Germany’s 10-year yield rose eight basis points to -0.28%.

- Britain’s 10-year yield jumped four basis points to 0.739%.

Commodities

- The Bloomberg Commodity Index was little change.

- West Texas Intermediate crude jumped to $55.96 a barrel.

- Gold decreased 0.3% to $1,468.30 an ounce.

Become an Insider

Become an Insider